Starting a business comes with many questions, like “How much will it cost?” An essential financial consideration to keep in mind as you plan to open a new company includes start-up costs. These costs are products and services that you have to purchase before you even open your doors. They’re distinguishable from expenditures like salaries and rent, which you’ll continue to pay after you open.

How To Calculate Start-Up Costs

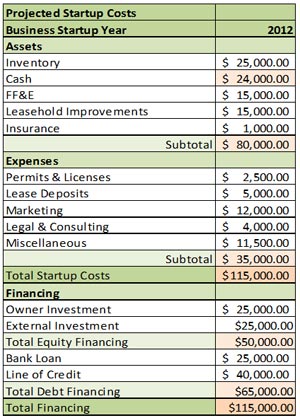

To calculate your business start-up costs, create a simple table in a spreadsheet and follow these steps:

- Create rows for assets and expenses.

Assets – Tangible items like furniture and equipment.

Expenses – Includes things such as consulting and legal fees.

- Itemize costs under each category in one column and enter the estimated spending in the next column.

- Create a SUM formula to automatically calculate the subtotal for each category and the grand total at the bottom.

Be bold and call around to get quotes on your list of items. Whether it’s renovations, incorporation fees, copywriting, or insurance, get multiple quotes and then create a reasonable budget for each item.

You can also try an online calculator to help estimate start-up costs and determine your line items. Be sure to add an amount at the end for “other” because you’re likely to forget something. It’s reasonable to set this amount at ten percent of the total.

The example below also includes lines showing how the start-up costs will be funded through equity investment, debt financing, or some combination.

A Note About Bootstrapping

Some entrepreneurs “bootstrap” their start-ups, meaning they spend as little money as possible on the launch and stretch every dollar as far as it can go. If you’re using a bootstrapping strategy, be careful not to underestimate your start-up costs.

You want to have a reasonable amount of working capital left over from start-up so that you’re in a strong financial position when your business finally opens.

Have you got your start-up costs in order? Now comes the fun part: finding funding sources.

Small Business BC is Here to Help

SBBC is a non-profit resource centre for BC-based small businesses. Whatever your idea of success is, we’re here to provide holistic support and resources at every step of the journey. Check out our range of business webinars, on-demand E-Learning Education, our Talk to an Expert Advisories, or browse our business articles.