Small Business BC is here to help British Columbia’s entrepreneurs navigate the unique challenges posed by COVID-19. Our team have been hard at work via phone and email responding to client questions on a wide range of subjects relating to the impact on small businesses.

With the rapidly shifting landscape, it can feel overwhelming to keep up with the latest information and resources. Let us help by gathering the most common questions (and best information we currently have at hand to answer) in one convenient place for our community to reference.

Q: Where can I receive financial support and funding to keep my business operating?

A: Both the Federal Government and Government of British Columbia have announced a range of financial programs to assist small businesses at this time. In most cases, these programs have been announced, but specifics on how the money will be distributed are not currently available. Programs include:

Q: How can I ready my business to apply for Government financial support?

A: Right now, we know that government supports are coming to help business owners. We also know additional funding will be available through traditional lenders launching new financing options. What we don’t know is the specifics, or how people will qualify for this support. That doesn’t mean you can’t prepare in advance. Start by creating a spreadsheet that documents your fixed and variable expenses, how many cancelled orders you’ve seen (and the dollar amount), insurance responses and the costs associated with your lease. You may be asked to provide these details, and this level of specificity will help the government refine who needs support and how it can best be deployed.

Q: I’m going to have to temporarily lay off employees. How do I handle it correctly?

A: While we encourage each employer to do everything in their power to avoid layoffs, we understand it can’t be avoided in some cases. We have published an article on What Employers Need to Know About Temporary Layoffs that’s been updated with information on Employment Insurance and COVID-19.

Q: Are there any alternatives to laying off employees?

A: Absolutely! The Government of Canada has put in place work sharing temporary special measures for employers affected by downturn in business due to COVID-19. These measures extend the duration of work sharing agreements by an additional 38 weeks, for a total of 76 weeks. The mandatory waiting period has also been waived. Click Here to find out more.

Q: What are the details for the temporary wage subsidy?

A: The Government of Canada has announced a 75 per cent wage subsidy for qualifying businesses, for up to 3 months, retroactive to March 15, 2020. This will help businesses to keep and return workers to the payroll. More details on eligibility criteria will start with the impact of COVID-19 on sales, and will be shared before the end of the month.

Q: Where can I find out more about Employee Insurance and COVID-19?

A: Visit the Federal Government’s dedicated Employment Insurance page to apply for EI benefits. Afterwards, you can apply to have the usual one-week waiting period waived by calling the government’s toll-free number at 1-833-381-2725. If there’s a need to lay off employees, ensure they’re receiving a record of employment as they will need this to apply.

Q: What if I don’t qualify for Employment Insurance?

A: The Government of Canada has announced the creation of an Emergency Response Benefit. Details on how the program will work:

We will provide a taxable benefit of $2,000 a month for up to 4 months to:

- workers who must stop working due to COVID19 and do not have access to paid leave or other income support.

- workers who are sick, quarantined, or taking care of someone who is sick with COVID-19.

- working parents who must stay home without pay to care for children that are sick or need additional care because of school and daycare closures.

- workers who still have their employment but are not being paid because there is currently not sufficient work and their employer has asked them not to come to work.

- wage earners and self-employed individuals, including contract workers, who would not otherwise be eligible for Employment Insurance.

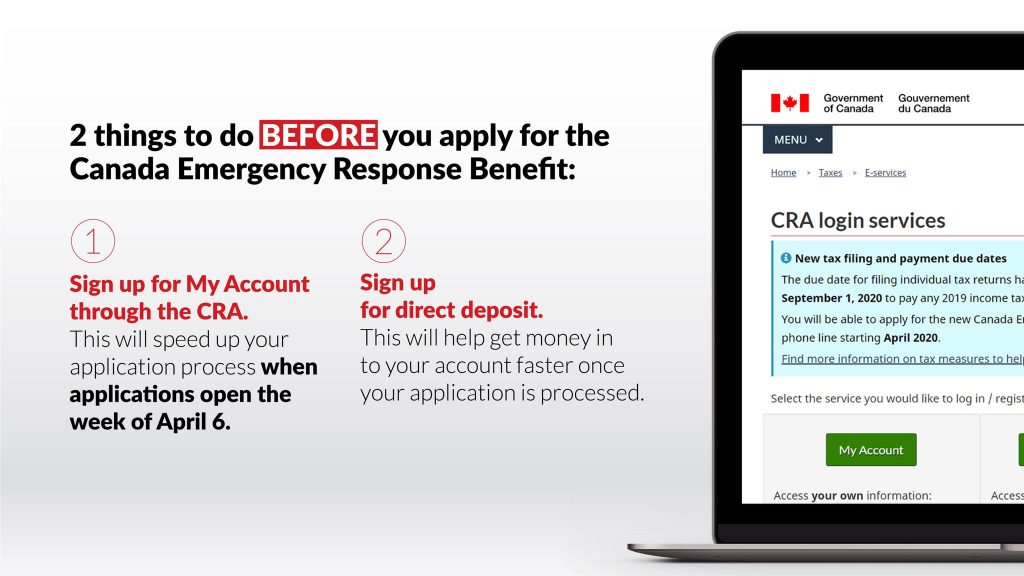

The Canada Emergency Response Benefit will be accessible through a secure web portal starting in early April. Applicants will also be able to apply via an automated telephone line or via a toll-free number. Below is a quick infographic on how to prepare:

Q: What supports are being offered by the Province of British Columbia?

A: British Columbians affected by the COVID-19 pandemic will benefit from $5 billion in income supports, tax relief and direct funding for people, businesses and services.

A new B.C. Emergency Benefit for Workers will provide a tax-free $1,000 payment to British Columbians whose ability to work has been affected by the outbreak. The benefit will be a one-time payment for British Columbians who receive federal Employment Insurance (EI), or the new Canada Emergency Response Benefit, as a result of COVID-19 impacts. Find out More.

Q: How can I support my favourite small business?

A: Now, more than ever, small businesses need our support. Read our article on how to support your favourite small business for practical tips on how to make a difference.

Q: How will COVID-19 affect import/exports and shipment of inventory?

A: Currently, there are no restrictions on the import or exports. While borders are beginning to close for leisure travel, there is no indication whatsoever this will affect commercial transport. If your business relies on transport by air, be aware most passenger airlines are currently scaling back operations but cargo services are continuing as normal.

Q: How can I minimize my business costs as much as possible?

A: Speak to your service providers/landlords if payments are upcoming. They are keenly aware of the situation and there will likely be room for flexibility in payment terms. In some instances, this is already happening:

- In recent days, the Canadian Government has announced all taxpayers can defer, until after August 31, 2020, the payment of any income tax amounts that become owing on or after mid-March and before September 2020.

- The Canada Mortgage and Housing Corporation (CMHC) is also permitting lenders to allow payment deferral beginning immediately.

- BC Hydro has also announced measures to help those struggling to meet their utility bills.

Q: My business relies on Temporary Foreign Workers, workers on visas or international students. What will happen to them?

A: Temporary foreign workers will still be allowed entry into Canada, despite restricted border measures, provided they self-isolate for 14 days, according to a statement made by Public Safety Minister Bill Blair.

Q: My staff are working remotely. What are some best practices?

A: For many businesses, COVID-19 has forced remote working on their team. Fortunately, it’s easy to maintain productivity even while the team is separated. Employers should schedule regular morning meetings, be clear in expectations, make sure employees have what they need to perform their role safely, and be patient – this is a time of tremendous anxiety and turmoil for everyone.

Q: What should I do if I become sick and can’t run my business?

A: Small Business BC and the B.C. Government Small Business Branch have prepared a joint Business Continuity Checklist that provides a checklist of considerations that small businesses can use to help minimize the impacts of COVID-19 to their employees and operations. Use this document to create a roadmap for how your business will continue.

This checklist is also available in the following languages:

- Korean (PDF)

- Punjabi (PDF)

- Simplified Chinese (PDF)

- Traditional Chinese (PDF)

Find Out More

Small Business BC has recently launched the B.C. Business COVID-19 Support Service to host all COVID-19 content and resources in one area. You’ll be able to talk to an advisor via live chat, or speak to them over the phone. Click here to find out more.